Monetary policy is dictated by central banks. These loans considered discount loans can help banks meet reserve requirements.

Key Points Monetary policy refers to the control and supply of money in the economy.

What are the tools of us monetary policy. Central banks have four main monetary policy tools. The reserve requirement open market operations the discount rate and interest on reserves. Most central banks also have a lot more tools at their disposal.

Here are the four primary tools and how they work together to sustain healthy economic growth. Key Points Monetary policy refers to the control and supply of money in the economy. Monetary policy is dictated by central banks.

The main three tools of monetary policy are open market operations reserve requirement and the discount rate. To accomplish this three tools are employed. The reserve requirement the open market purchase or sale of government bonds and the discount rate.

This lesson illustrates these three tools and explains the relative importance of each to monetary policy makers. The Federal Reserve has a variety of policy tools that it uses in order to implement monetary policy. Discount Window and Discount Rate.

Interest on Required Reserve Balances and Excess Balances. Overnight Reverse Repurchase Agreement Facility. Commercial Paper Funding Facility.

The TDF was established to facilitate the conduct of monetary policy by providing a tool that may be used to manage the aggregate quantity of reserve balances held by depository institutions and in particular as with reverse repos to support a reduction in. Monetary Policy Tools. All central banks have three tools of monetary policy in common.

First they all use open market operations. They buy and sell government bonds and other securities from member banks. This action changes the reserve amount the banks have on hand.

A higher reserve means banks can lend less. Thats a contractionary policy. Central banks control the money supply in the economy through monetary policy.

To do that they can resort to three main monetary policy tools. Open market operations the discount rate and reserve requirements. Open market operations are a means to control the money supply by buying or selling bonds on the open market using newly created money.

The three main tools of monetary policy are open market operations reserve requirements and interest rates. Let us define monetary policy and then look at each tool briefly. Tools of Monetary Policy Open market operations Affect the quantity of reserves and the monetary base Changes in borrowed reserves Affect the monetary base Changes in reserve requirements Affect the money multiplier Federal funds ratethe interest.

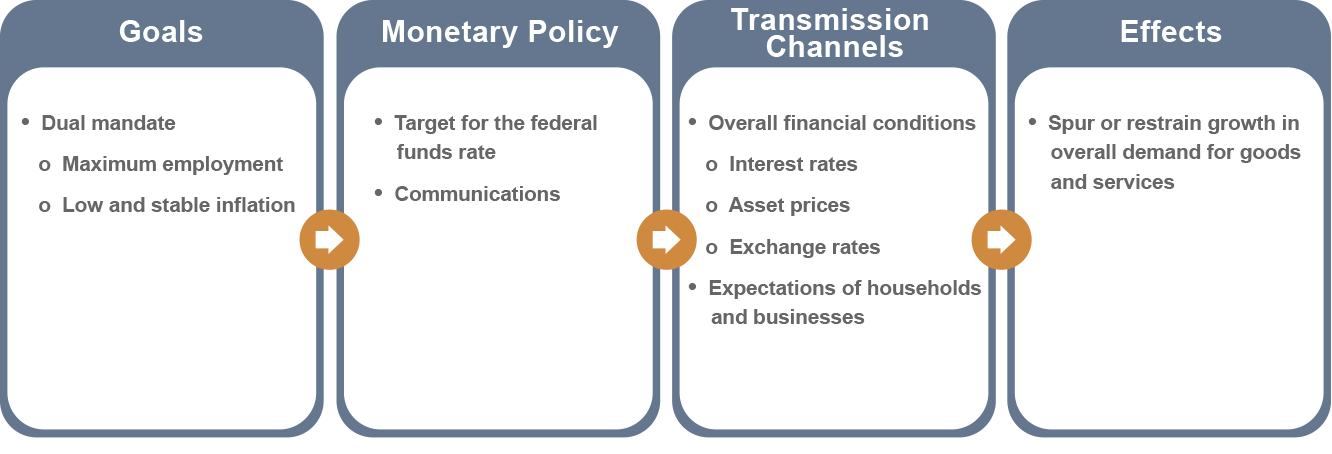

What are the tools of US. The Fed cant control inflation or influence output and employment directly. Instead it affects them indirectly mainly by raising or lowering a short-term interest rate called the federal funds rate.

The new tools of monetary policy Central bank purchases of longer-term financial assets popularly known as quantitative easing or QE have proved an. Forward guidance though not particularly effective in the immediate post-crisis period became increasingly powerful. Some major foreign central.

Controlling the discount rate the rate of interest used by a central bank when loaning money to other banks is one of the monetary policy tools available to a nations central bank. These loans considered discount loans can help banks meet reserve requirements. They also maintain a sufficient balance to cover depositor withdraws.

Monetary policy concerns the actions of a central bank or other regulatory authorities that determine the size and rate of growth of the money supply. For example in the United States the Federal Reserve is in charge of monetary policy and implements it primarily by. Money growth in the economy can occur through the multiplier effect resulting from the reserve ratio.

For example a reserve ratio of 20 will result in 80 of any given initial deposit being loaned out and if the process of loaning is assumed to continue the maximum increase in money expansion specific to an initial deposit at a 20 reserve ratio will be equal to the. The Tools of Monetary Policy - YouTube. The Tools of Monetary Policy.

If playback doesnt begin shortly try restarting your device. The Federal Reserves three instruments of monetary policy are open market operations the discount rate and reserve requirements. Open market operations involve the buying and selling of.

The most commonly used tool of monetary policy in the US. Is open market operations. Open market operations take place when the central bank sells or buys US.

Treasury bonds in order to influence the quantity of bank reserves and the level of interest rates. The specific interest rate targeted in open market operations is the federal funds rate.