Central government general government and the public sector and for any definition of government there are many measures of the debt and deficit including those generated by four kinds of accounts cash financial full accrual and comprehensive which can be derived from four nested sets of assets and liabilities. Over time persistent budget deficits can hamper economic growth.

The deficit is primarily funded by selling government bonds gilts to the private sector.

Economic definition of deficit. In financial terms a deficit occurs when expenses exceed revenues imports exceed exports or liabilities exceed assets. A deficit is synonymous with a shortfall or loss and is the opposite of a. Summary In terms of finance deficit refers to a shortfall of certain economic resources mostly money.

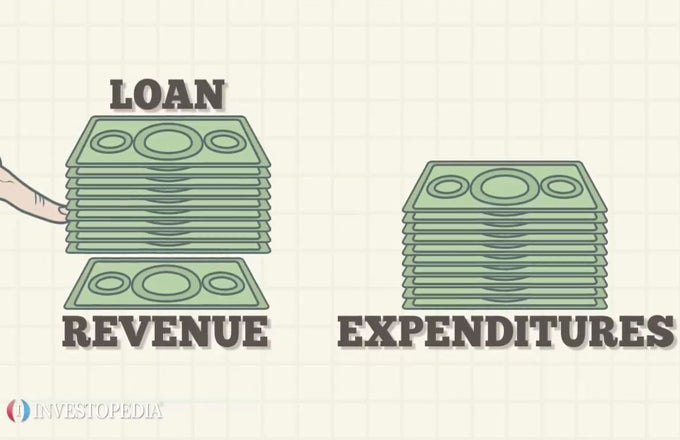

Since deficit implies a shortage of funds or an excess of cash outflows over inflows it does not present a favorable. Fiscal deficits and trade deficits are among the most important kinds of. Economic deficit is a status of financial health in which expenditures exceed revenue more money being spent than coming in.

The term budget deficit is most commonly used to refer to government spending rather than business or individual spending. A budget deficit is when spending exceeds income. The term applies to governments although individuals companies and other organizations can run deficits.

A deficit must be paid. If it isnt then it creates debt. Each years deficit adds to the debt.

Debt is the accumulation of years of deficit and the occasional surplus. Over time persistent budget deficits can hamper economic growth. Deficits represent an intertemporal transfer from later generations to the current one as money borrowed now will eventually require repayment with interest.

The effect of deficit financing on economic output. A deficit is usually financed through borrowing from either the central bank of the country or raising money from capital markets by issuing different instruments like treasury bills and bonds. The deficit is the annual amount the government need to borrow.

The deficit is primarily funded by selling government bonds gilts to the private sector. Summary of effects of a budget deficit Rise in national debt. General government deficit is defined as the balance of income and expenditure of government including capital income and capital expenditures.

Net lending means that government has a surplus and is providing financial resources to other sectors while net borrowing means that government has a deficit and requires financial resources from other sectors. Definition of deficit 1 a 1. Deficiency in amount or quality a deficit in rainfall 2.

A lack or impairment in an ability or functional capacity cognitive deficits a hearing deficit. The deficit is the addition in the current period year quarter month etc to the outstanding debt. The deficit is negative whenever the value of outstanding debt falls.

A negative deficit is called a surplus. Federal Debt from the Concise Encyclopedia of Economics. Updated February 08 2021.

Deficit spending occurs when purchases exceed income. It happens to individuals and businesses but it usually refers to governments. Governments have strong incentives to spend more than they take in and few reasons to balance the budget.

In the United States the Bureau of Economic Analysis measures and defines the trade deficit. Imports as goods and services produced in a foreign country and bought by US. It includes all goods shipped to the United Stateseven if produced by an American-owned company.

If a product goes through US. Customs and is intended to be sold in America it is. Economys reliance on consumption and low prices has created a large deficit in the balance of payments.

Unchecked a long-term rising deficit can lead to inflation and a lower standard of living. What It Means. A countrys balance of payments tells you whether it saves enough to pay for its imports.

It also reveals whether the country produces enough economic output to pay for its. Gross Primary Deficit is Gross Fiscal Deficit less interest payments. Net Primary Deficit is Net Fiscal Deficit minus net interest payments.

Net interest payment is interest paid minus interest receipt. A shrinking primary deficit indicates progress towards fiscal health. The Budget document also mentions deficit as a percentage of GDP.

This is to facilitate comparison and. Central government general government and the public sector and for any definition of government there are many measures of the debt and deficit including those generated by four kinds of accounts cash financial full accrual and comprehensive which can be derived from four nested sets of assets and liabilities. Each debt and deficit measure says.

Economics the process of reducing the amount by which a governments spending is more than the money it receives in taxes etc. A deficit reduction package plan target.